1

Rate of Interest

Most Card companies charge 2.5% - 3.9% pm of interest if you don’t pay 100% of the dues.

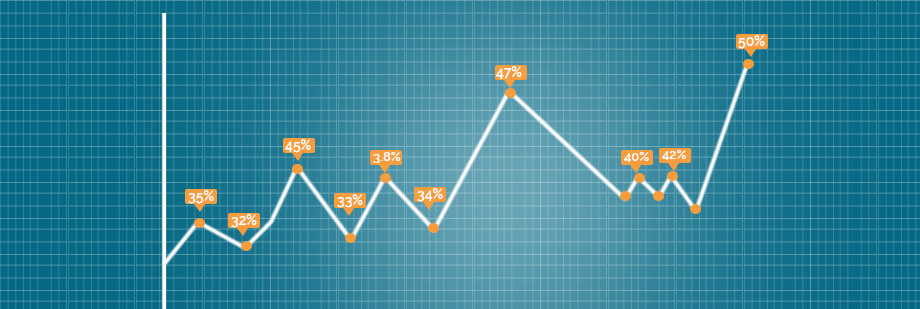

All Card companies quote the interest rates as monthly but when you look at it is 30%-50% yearly.

So if you have a 1 lac due on your card you will have to pay Rs 2500- 4100 monthly as interest and which is as high as Rs 30000-50000 yearly.

Remedy

Only use Credit Card as a convenience of not to carry cash and pay 100% on due date and only use 30-45 day of free credit period given by Bank. Never use Credit Card when you are not sure that you can pay 100% of your dues.

All Card companies quote the interest rates as monthly but when you look at it is 30%-50% yearly.

So if you have a 1 lac due on your card you will have to pay Rs 2500- 4100 monthly as interest and which is as high as Rs 30000-50000 yearly.

Remedy

Only use Credit Card as a convenience of not to carry cash and pay 100% on due date and only use 30-45 day of free credit period given by Bank. Never use Credit Card when you are not sure that you can pay 100% of your dues.